Get This Report about USDA Loan - Learn more - Guild Mortgage

The Buzz on USDA Mortgage Loans - Hometown Lenders

Just like a conventional home loan, your loan provider will look at your credit history, earnings, and your employment info. If you're pre-approved, you'll get a letter in the mail. This letter will help more loan providers take you more seriously. When you get your pre-approval letter, you can start trying to find houses in the USDA authorized locations.

As soon as you've made an offer on a home, get your loan provider's complete approval. Make certain that your representative knows that you're utilizing a USDA loan so that the seller will pay any clothing costs. They'll do one last check of your certifications, the USDA loan status, and the residential or commercial property you made an offer on.

How What are the Benefits of a USDA Loan? - Moreira Team can Save You Time, Stress, and Money.

Your loan provider will submit your updated loan profile back to the USDA, and they'll double inspect whatever. If whatever remains in order, they'll give their approval and accept the loan. When the USDA validate the loan, your lender can begin the closing process on your new house.

USDA Loans in Florida - Moreira Team Mortgage

All of the documentation will get signed, a closing date will be set, and the loan will go through for payment on your house. The qualification procedure for the USDA loan takes, usually, 2 to three weeks more than a standard mortgage will take. You can anticipate around 40 days from the contract date to the closing date.

USDA Home Loans: Rural Development Loan & Property Mortgage Eligibility Requirements

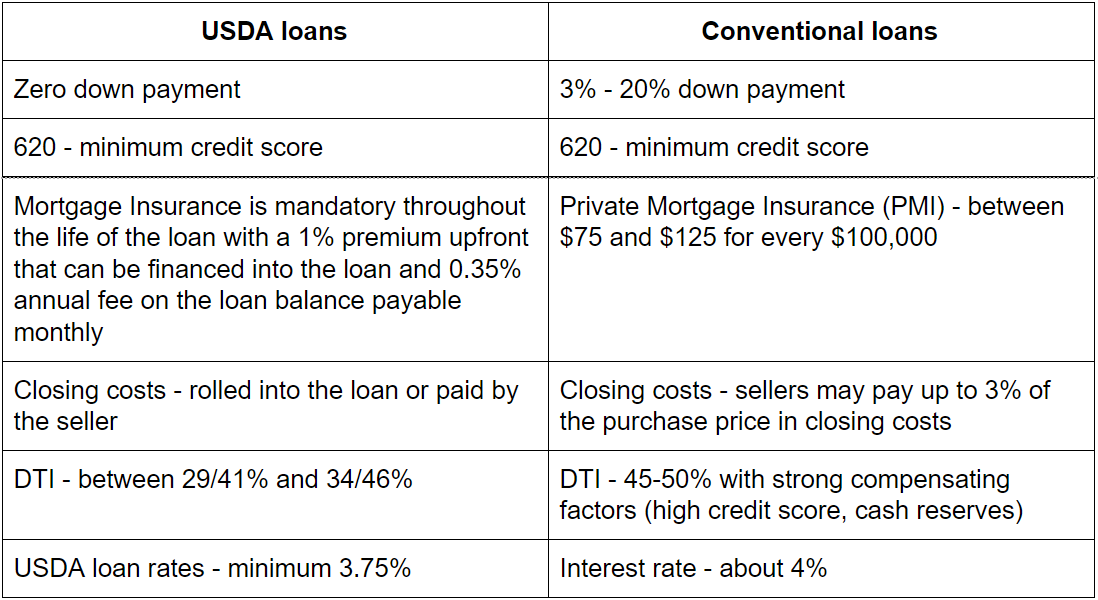

USDA VsConventional Home Loans - Rocket Mortgage for Beginners

As soon as you've sent your application, you can either call your lending institution's workplace, use loan tracking services, or check the automated email for status updates. Find More Details On This Page May Qualify for a Low-rate USDA Home Loan Check out today to prequalify. The 3 USDA Loan Programs and Their Distinctions The USDA offers 3 various loan programs for people to participate in.

You will not have a deposit with any of these 3 loan alternatives. Nevertheless, they all have different earnings standards you'll have to satisfy to apply effectively and get approved for. USDA Direct Loan The USDA Direct Loan gets all of its financing directly from the USDA, and this is distinct as the majority of government-backed loan programs don't get funding directly from the source.